Collectors take note. Collectibles have been targeted by the Australian Taxation Office (ATO). That’s right! The government has got its money-grabbing little hands on your prized possessions. Non-compliance with the new legislation brings fines. Yet, compliance means you can’t even take your collectibles for the odd spin or admire them up close.

It’s not all bad news though we’re only talking about collectibles that have been purchased via your Self Managed Super Fund (SMSF).

Collectibles and SMSFs

Once you’ve woken from your legal jargon slumber and wiped the drool from your bottom lip, understanding the new rules in relation to collectibles or personal use assets tied up in your Super Fund is simple.

The changes came about after the Federal government appointed Jeremy Cooper, the former deputy chairman of ASIC and a panel of seven part-time members to conduct a review of Australia’s superannuation system on 29 May 2009. The Super System Review was charged with proposing an outcome that would be in the best interests of members to maximise retirement incomes for Australians. The terms of the review were to examine and analyse the system to achieve:

- better governance

- greater efficiency

- improved structure

- clearer operations

Like all good government recommendation appointees, Mr Cooper decided it would be prudent to abolish all investments in art work. Much to the government’s credit (because you have to give them something and many of them probably have art work assets), their response was to allow collectibles and personal use assets under increased compliance requirements that must be met if the SMSF is to hold the collectible investments.

The guidelines were recently finalised, and came into effect in July 2011, to ensure that superannuation entitlements are accumulated for retirement income purposes, not current day benefits.

In fact, this has always been the case. According to superannuation expert Sharon Gdanski , “It has always been SIS regulations that a member cannot obtain current benefits from any superfund asset; you could never display artwork in your home, drink wine from your wine collection or even stay one night in a residential property owned by the fund.

Members are not to receive current day benefits; a superfund is for your retirement or death. If they did it is considered a breach of the sole purpose test and depending on the extent of the breach could even render the fund non complying.”

The new regulations refer to:

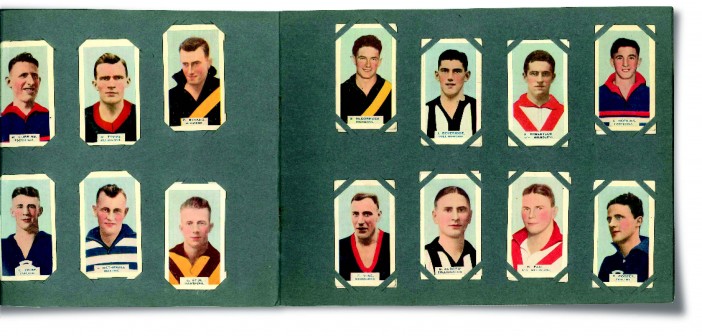

- artwork

- jewellery

- antiques

- artefacts

- coins, medallions, bank notes

- postage stamps or first day covers

- rare folios, manuscripts or books

- memorabilia

- wine or spirits

- motor vehicles

- recreational boats

- memberships of sporting or social clubs

- assets of a particular kind, if assets of that kind are ordinarily used or kept mainly for personal use or enjoyment (not including land).

In other words, if you’ve purchased something through your SMSF that you thought you’d have a bit of fun with at home, you better think again. What you now need to do is gather yourself a posse to drive your Mustangs out of your high tech garage and into a neutral holding venue.

You are bound by restrictions on where collectibles and personal use assets can be stored and who can access them, unless as stated they are counted as in-house assets that are less than 5% of the total fund investment.

“If this is the case you can store your wine in a cellar as long as it is separate from your personal use wine,” Sharon says. “You could store jewellery in a safe and you can park a car in your garage and drive it occasionally to keep the motor in order and the car working, but you cannot drive it daily or even weekly.”.

The restrictions specify that the investment cannot:

- be leased to, or part of a lease arrangement with, a related party;

- be used by a related party;

- be stored in a private residence of a related party.

Further to this, a written record is required outlining the decision. “A strategy must be determined/minuted when a collectible is purchased.” According to Sharon, “This documentation must be kept for at least 10 years after the decision is made. This is to ensure the SMSF Trustee has given consideration to what is appropriate storage for maintaining the investment.” It must form part of your investment strategy.

Further changes include: insuring investments in the name of the SMSF within seven days of acquisition (club memberships do not apply). Each Fund-owned collectible must be insured by the Fund under either separate policies or collectively under one policy. Sharon says, “It should always have been insured in the name of the Super Fund as it belongs to the Super Fund.” Secondly, if an asset is sold to a related party it must be sold at market value determined by an independent valuer to ensure you are kept at arm’s length of the transaction.

The legislation came into play from July 2011. It means that anything purchased after that date must immediately comply. For those with collections purchased before this date, you have until July 2016 to comply or offload the asset.

Decisions, decisions

The question now is whether it is worth holding a collectible asset under a SMSF? Imagine having a wine collection that on a whim you are unable to sample, show off, or allow to gather dust in your basement cellar. Imagine not being able to take the Mustang for a weekend spin through the Black Spur to maintain its condition and value. It’s not just you who can’t take the car out either, it’s any member related to the Fund including relatives, Fund partners, Trusts or companies in control of the Trust. The only people who can take your vehicle for a maintenance drive are non-related Fund friends. In other words, your best mate.

The new rules are strict. It doesn’t mean to say you can’t invest in collectibles, it means that they cannot be stored in any residence or business related to the SMSF.

If you encounter any trouble with your SMSF collectible investment, you will be required to offload the investment or face a $2,200 fine. The ATO will fine you more, or impose penalties on your Fund, if your breaches warrant harsher penalties.

When it comes down to it, you have to ask yourself a question. Do you feel lucky? We suggest that luck plays no part in this. If you wish to invest in a collectible through your SMSF, then ensure that personal use is of no consequence. If you want your investments close to you so you can enjoy them, buy them privately and keep the Trust at bay.

This article is information of a general nature. Consult your superannuation specialist or financial advisor before making any decisions.

What you need to know about your SMSF

1. All SMSF investments should form part of the Fund’s investment strategy and be permitted by the Trust Deed.

2. Collectibles owned by a Fund cannot be kept at any private residence or residence related to the Fund.

3. A written record must be made with regard to the location of the investment.

4. This document must be kept for 10 years.

5. The investment must be insured in the name of the SMSF within seven days.

6. If the investment is sold to a related party, it must be sold at market price.

7. The sale price must be determined by an independent valuer with formal valuation experience, education or judgement.

8. There will be an increase in administration and compliance costs, including valuation, insurance and storage.